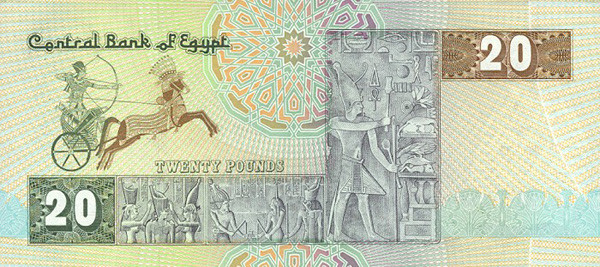

Prior to the pound, the standard Ottoman unit of currency, the kurus, was adopted in Egypt. Read on to learn about the history of the Egyptian Pound. The Egyptian pound is also represented as LE, for livre égyptienne French for Egyptian pound. Ever since its introduction, the Egyptian pound also called ‘gineh’ has undergone a number of changes which reflect the economic and political development of the country. The Egyptian pound, EGP, is Egypt's official currency, and just like Egypt, the currency also has a complex yet rich history. The most commonly used banknotes include 5 Piastre, 10 Piastre, 25 Piastre, 50 Piastre, LE 1, LE 5, LE 10, LE 20, LE 50, LE 100, and LE 200.Įgyptian Pound - History of the Egyptian Pound The most frequently used coins are 1 Piastre, 5 Piastre, 10 Piastre, 20 Piastre, 25 Piastre, 50 Piastre, and LE 1.ģ. The short name for the Egyptian Pound is EGP.Ģ. Some Facts That You Ought To Know About The Egypt Currency:ġ. Currently, it is not pegged to any of the international currencies. Moved from the US dollar to the British Pound. The Egypt currency was earlier pegged to the US Dollar at 1 EGP is equals to 2.3 USD. Digitally the currency is symbolized as E£ and £E. One Egyptian Pound is divided into 100 Piastres or Ersh. Popularly known as Gineih and Qirsh, the Egyptian Pound is the official currency of the Arab Republic of Egypt. (ii) Tax Collection at Source (TCS) at the rate of 20% will be levied under section 206C(1G)(b) of the Income Tax Act on all other remittances not covered in (i) above without any threshold limit in a financial year under the Liberalised Remittance Scheme of the Reserve Bank of India.The TCS collected will be reflected in the 26AS of the payer for claiming Income Tax credit. (i) Tax Collection at Source (TCS) at the rate of 0.5% or 5% as applicable will be levied under section 206C(1G)(b) of the Income Tax Act on remittance on account of Education purpose or Medical purpose, if the aggregate amount exceeds Rs.7,00,000 in a financial year under the Liberalized Remittance Scheme of the Reserve Bank of India. The non-refunded TCS will be reflected in the 26AS of the payer for claiming Income Tax credit. In the event of cancellation of services and refund of amount, Tax collected at source under section 206C(1G) of the Income Tax Act, 1961 shall not be refunded. The TCS collected will be reflected in the 26AS of the payer for claiming Income Tax credit. 7,00,000 in a financial year for remittance out of India under the Liberalised Remittance Scheme of the Reserve Bank of India. Further TCS under section 206C(1G)(a) of the Income-tax Act, 1961 at the rate of 5% will be collected if the aggregate amount exceeds Rs. Tax Collection at Source (TCS) at the rate of 5% will be levied under section 206C(1G)(b) of the Income Tax Act on outbound tour services.

This blocked rate will be valid for 2 working days. You may block foreign currency by paying 2% of total transaction value.You can further add/edit travellers in preconfirmation page which can impact the total amount. This amount is calculated considering one traveller.

0 kommentar(er)

0 kommentar(er)